Effective Collection Practices

by Darrel Hewson

In today's difficult business environment, having an effective collection strategy in place is imperative to having a short DSO and healthy cash flow. Building this foundation is the fundamental challenge many companies are faced with as there are multiple facets to building a strong and robust collection strategy. These range from credit controls, contact matrices, dispute management processes, and Service Level Agreements (SLAs) to policies covering the nature and process of escalating payment demands.

In today's difficult business environment, having an effective collection strategy in place is imperative to having a short DSO and healthy cash flow. Building this foundation is the fundamental challenge many companies are faced with as there are multiple facets to building a strong and robust collection strategy. These range from credit controls, contact matrices, dispute management processes, and Service Level Agreements (SLAs) to policies covering the nature and process of escalating payment demands.Why not just continue to write off those bad debts? What hits the bottom line of your costs ultimately requires growth to the top line in sales. Let's use an example to illustrate how recovering from bad debts impacts your total business. Take a relatively small outstanding debt balance of $2,500 and assume, for this example, the company is operating at a 3% profit margin. Here's the equation to use: (Write-off) / (% Net Profit) = Additional Sales to Compensate the Write-off So using the information in our example:

($2,500 Write-off)/(3% Net Profit) = $83,333

in Additional Sales to Compensate the Write-off

To most businesses, $83k is a significant amount to have to come up with in sales to simply offset a writeoff you may not have had to incur in the first place. So we'd like to provide you with 4 steps to help make your collection practices as effective as possible and improve your cash flow.Step 1 -- Have Everyone Complete a Credit Application

Credit control begins with the completion of a credit application by all

prospective customers. Having complete and accurate data not only helps with

your ability to make an appropriate credit decision, but it provides valuable

information that can be used in the collection process. Your credit application should minimally include:

- The company's full and correct legal name

- Full addresses (both mail and shipping)

- Telephone, fax and emails of both the contract signer and Accounts Payable

department

- Banking information

- Credit references

In some cases, where a company may not have sufficient credit standing, a personal guarantee by an offi cer or stockholder of the company may be prudent if the guarantor has available assets. The Personal Guaranty can be in the form of a Guaranty of Payment or in the form of a Guaranty of Collection. The difference being that the Guaranty of Payment allows the fi rst attempt at collection to be made against the Guarantor, while the Guaranty of Collection requires you to fi rst exhaust all your efforts against the company before going to the Guarantor. Your credit application should also include your "Terms of Agreement". Included in this should be such things as your standard rates and conditions, late fees, and any collection costs and/or court fees that the debtor may be responsible for should they default. With these critical details included, the customer's completion of this document will then be able to be used as legal proof of their understanding and acceptance of these important elements of your business transaction with them. Should the collection ever need to escalate to a legal process, the courts will look to this acceptance of terms by the debtor as a very strong factor in your favor. In most cases, courts will not award costs unless they have been agreed to with the Terms of Agreement. This is why it is important to state if late fees, collection costs and/or court fees would be charged to the debtor. We recommend you consult with legal counsel to make sure that you obtain their professional advice in preparing your credit application and Terms of Agreement. This is also important as there are different laws governing the collection remedies available to you as a creditor for a corporation versus a business under sole proprietorships, as well as regulation that can vary from state-to-state or country-to-country. Step 2 -- Create and Document Your Collection Process

Companies that have implemented and maintained comprehensive collection processes and procedures have a much stronger portfolio base than those companies who have not enforced strict credit and collection policies. The reason for this is because it sets the expectations for a true business partnership and relationship, with nothing left unresolved. There are parts to your plan which will be consistent with all other businesses and how they do things, and then there will be parts that will be unique to your company's needs and the expectations of the customers within your industry.

|

|

Designing and implementing a vigorous contact strategy or "treatment matrix", which includes personal contact via telephone calls and written communications strategically positioned and timed based on risk, dollar balance, age, customer sensitivity and first payment defaults, is imperative to creating a viable collection process. It's also extremely important to have included in your documented process regular intervals at which time you re-visit your treatment process to make adjustments consistent with any changes in your portfolio and your customer's payment habits. Many of the more sophisticated collection tools available today calculate account/customer level risk information for you such as the Current Days to Pay or Average Days to Pay. Integrating this level of risk data into your process and plans allows you to dynamically impact those accounts who are most adversely impacting your past due and Days Sales Outstanding (DSO), and those that pose the greatest risk of becoming a bad debt.Best-practices continually illustrate establishing customer segmentation as a key to a company's success in collecting their open A/R. This segmentation is in regard to the customers in your portfolio and arranging them into tiers based on the balances due. For example, Tier One customers may be comprised of high balance accounts. In most cases, this tier usually represents only 10% of the total customers, but 60% of the outstanding dollars. Using this model, your Tier Two accounts are those with moderate balances and Tier Three customers represent small dollar balances. The Tier Three group usually accounts for 60% of the accounts, but only 10% of the dollars so it is the direct opposite of your Tier One accounts. Utilizing this segmentation model allows your company to assign the most skilled collectors to the section of a portfolio with the most exposure, your high balance Tier One accounts. A skilled collector can provide a customer service oriented call designed to uncover and validate issues which need to be resolved in order to gain closure, which is ultimately the prompt payment of the open balance. Developing the skills of your collection team, supported by a documented process, management backing, and the technology tools they need to do their job effi ciently and effectively, will allow your team to succeed. Another critical aspect of an effective collection strategy is capturing collector activity/notes on an account that all your team can access and understand. These notes should include the dates, times, names, and titles of each and every contact effort that is made and the result of the contact whether the person you were attempting to reach was available or not. In a dispute, these detailed notes will help facilitate the resolution of any customer issues, and support collection escalation when necessary. Since most customers intend to pay their obligations lets fi rst look at the reasons why customers won't pay their bills before we look at what to do when they can't pay their bills. Step 3 -- Include a Dispute Management Plan (Won't Pay)

Despite your best efforts, miscommunications and disputes will arise from your collection process, so having a dispute management plan in place is integral to having a successful credit and collection process. Like a good collection strategy, a good dispute management process will have established timelines and Service Level Agreements (SLAs) supported by requirements on tracking communications and defi ning the dispute type. Creating this history as your team works through the dispute process will enable you to identify the root cause of the dispute and see if this is something unique or showing a pattern of repeating itself so that it may be addressed in your regular process reviews. Some valid disputes stem from processes and situations that occur below or above what your A/R team is responsible for in the Order-to-Cash process stream. These situations will need to be addressed and supported by other areas of your organization. For example, a customer may be disputing both a delivery charge and the product/service quality; different departments within your organization may need to be involved in resolving these questions. Often, collectors become the facilitators between the customer and company to resolve a dispute, so providing them with the necessary tools and support companywide to manage the relationship will provide substantial dividends. With a documented process in place, your collectors can provide the customers with reasonable and specifi c expectations as to when and how their dispute will be resolved, including when they can expect to hear back from your team on any disputes. With a dispute management plan and process, including internal SLAs with your businesses' internal counterparts, everyone involved knows exactly who will do what and how long it may take so that communications with the customer are clear. The leading collection tools have the functionality to track and measure compliance against metrics and report the results through the executive levels of your organization. When working with past due customers, collectors need to have support from within their own organization so that they can leverage the need for payment against the customer's need for your product or service. A Credit Suspension Process should be included in your Dispute Management Plan that will not only provide the needed leverage to collect, but which can also mitigate overall exposure to delinquent accounts. Making sure that the suspension process is clearly understood by your entire organization, so that there is complete support and compliance, is critical. You do not want your sales team making promises that your fi nance team is not able to support -- the internal confl ict resulting only compounds the very awkward situation now created with the customer. Step 4 -- Know When to Ask for Help (Can't Pay)

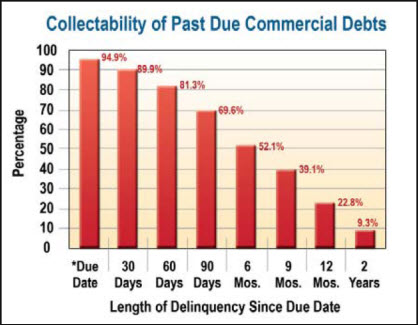

No matter how effective your credit and collection process is, you will still have bad debt and you should have a process in place dictating when to move an account from your internal process to an outside agency. While companies can be reluctant to do this, the companies that have a well-defi ned process in place which includes this step, have a greater recovery rate. There are many factors that can impact the timing of a placement to someone outside your team, but in general an account that reaches 120 to 150 days past due and does not have any open disputes identifi ed, should be placed with an agency. Successful recoveries by an outside collection agency should not be viewed as internal failure, rather part of a sound credit and collection strategy. For instance, the typical commercial transaction has a likelihood of being collected 94% of the time at 30 days past due. This same receivable at 120 days past due has only a 58% likelihood of being collected. If by day 180, the account has not been appropriately escalated, the odds of now collecting are reduced to just 27%.

Now is not when you want to just start looking for a collection agency or to just pick whoever you locate first -- you want to have established a working relationship with a licensed, reliable agency in advance so that you can maintain your cash flow strategy. Selecting an agency with the right expertise and credentials will go a long way towards impacting your recoveries, while reducing any concerns you may have over your image in the marketplace and maintaining a good working relationship with your customers. Reputable agencies know the strategy to use on your behalf, and how to leverage collection tools such as skip tracing, credit bureau reporting and legal proceedings. A good agency will have trained, experienced personnel who will utilize the right amount of effort required to get payments made while following all of the state and federal laws governing collection practices.

* Due date may be several months from delivery date depending on the industry

|

|

The best collection agencies will utilize their tools and experience to make contact with the debtor, work through any past relationship diffi culties prior collection efforts may have created, provide alternative payment suggestions, and work with the debtor to develop a plan for payment they can achieve. This process ultimately satisfi es both the creditor and debtor while strengthening working relationships. To review, the 4 steps to effective collection practices are:

- Have Everyone Complete a Credit Application

- Create and Document Your Collection Process

- Include a Dispute Management Plan

- Know When to Ask for Help

Granted, developing these processes and training your team and their counterparts throughout your organization takes time and effort, but is sure to save you significantly in the long run. Utilizing these steps can also help you avoid reaching the point where pre-legal or legal litigation is necessary, however with appropriate discretion, it may be imperative to utilize this final collection tool as well. Darrel Hewson is a Vice President of Business Development for RMS, a leading A/R optimization outsourcer. He has over 25 years of experience in the credit and receivables industry with a specialized focus in the development and implementation of Order-to-Cash solutions. Utilizing his Certifi cation of Achievement in Six Sigma Green Belt and knowledge, Darrel leads a team of RMS experts and consultants to tailor these solutions to the unique requirements of each client. If you would like to obtain additional information regarding the topics discussed here, or if you have any other questions concerning your A/R processes, please contact Darrel at:

RMS - The Receivable Management Services Corp.

240 Emery Street

Bethlehem PA 18015

Toll Free: 866-205-9947

Tel: 484-242-6685

Email: darrel.hewson@rmsna.com

www.rmsna.com

Note: The above article originally appeared in the Summer 2010 Issue of the Commercial Collection Agency Association's Collage newsletter.

|